Service Design Case Study: Barclays - Truly Connected Finance

A detailed case study on the Barclays "Truly Connected Finance" (TCF) initiative, outlining the strategic approach to redefine customer relationships, build confidence, and deliver market impact.

Published: 17 October 2019

1. The Starting Point: Envisioning “Truly Connected Finance” for Barclays

In September 2019, Barclays, in collaboration with the design and innovation consultancy Eight Inc., embarked on a pivotal strategic initiative known as the “Truly Connected Finance” (TCF) Strategy Kickoff. The core ambition of this project was to fundamentally redefine Barclays’ relationship with its customers and energise its teams by bringing the concept of “Truly Connected Finance” to life. This endeavour sought to craft an inspiring vision, develop tangible customer-value-propositions (CVPs), and design signature moments of interaction. Crucially, the project aimed to deliver a clear plan of action with the potential for significant market impact, aspiring to elevate Barclays beyond the perception of a mere utility provider into a trusted financial partner. The initial strategic work, encompassing the “Immerse,” “Envision,” and “Socialise” phases, was set within an intensive six-week period, focusing on Barclays’ core consumer and business banking propositions and the development of an adaptable customer experience framework for the years ahead.

2. The Challenge: Navigating Market Disruption and Internal Misalignments

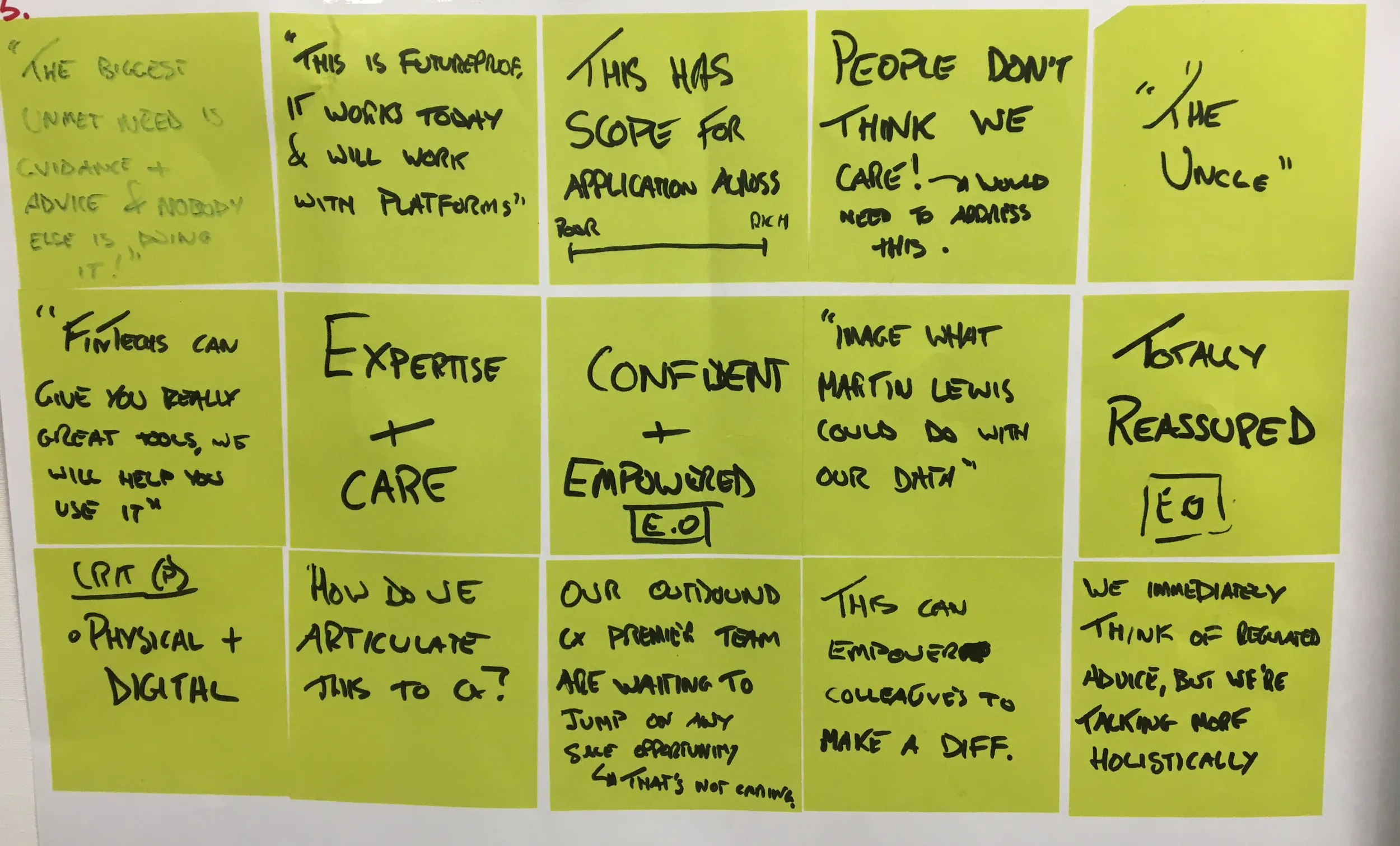

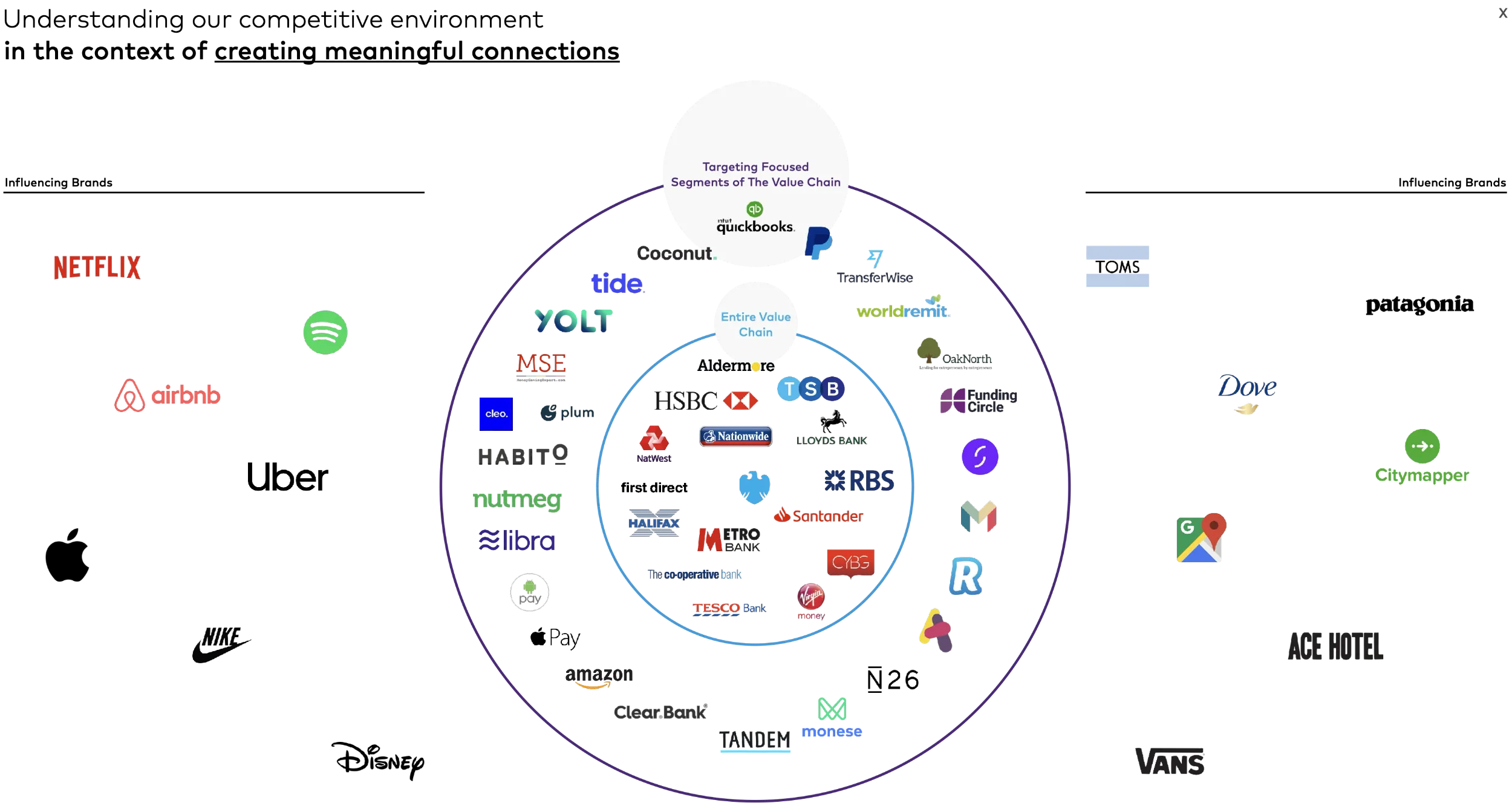

Barclays faced a complex set of challenges as it sought to innovate. The broader context was an “age of anxiety,” with customers feeling less in control and facing rapid disruption from agile fintech challengers and technology giants encroaching on the financial services space. Internally, a series of “Observation Headlines” captured a candid view of the prevailing conditions: while there was a shared desire to make a positive impact and alignment on the opportunities for differentiated value, the organisation also grappled with “conflicting views on what we need to do today” and a sense that “our investment isn’t aligned to a clear strategy.” Furthermore, there was a noted “misalignment on the value we should create” and a lack of clarity on the bank’s strategic “stand on advice.”

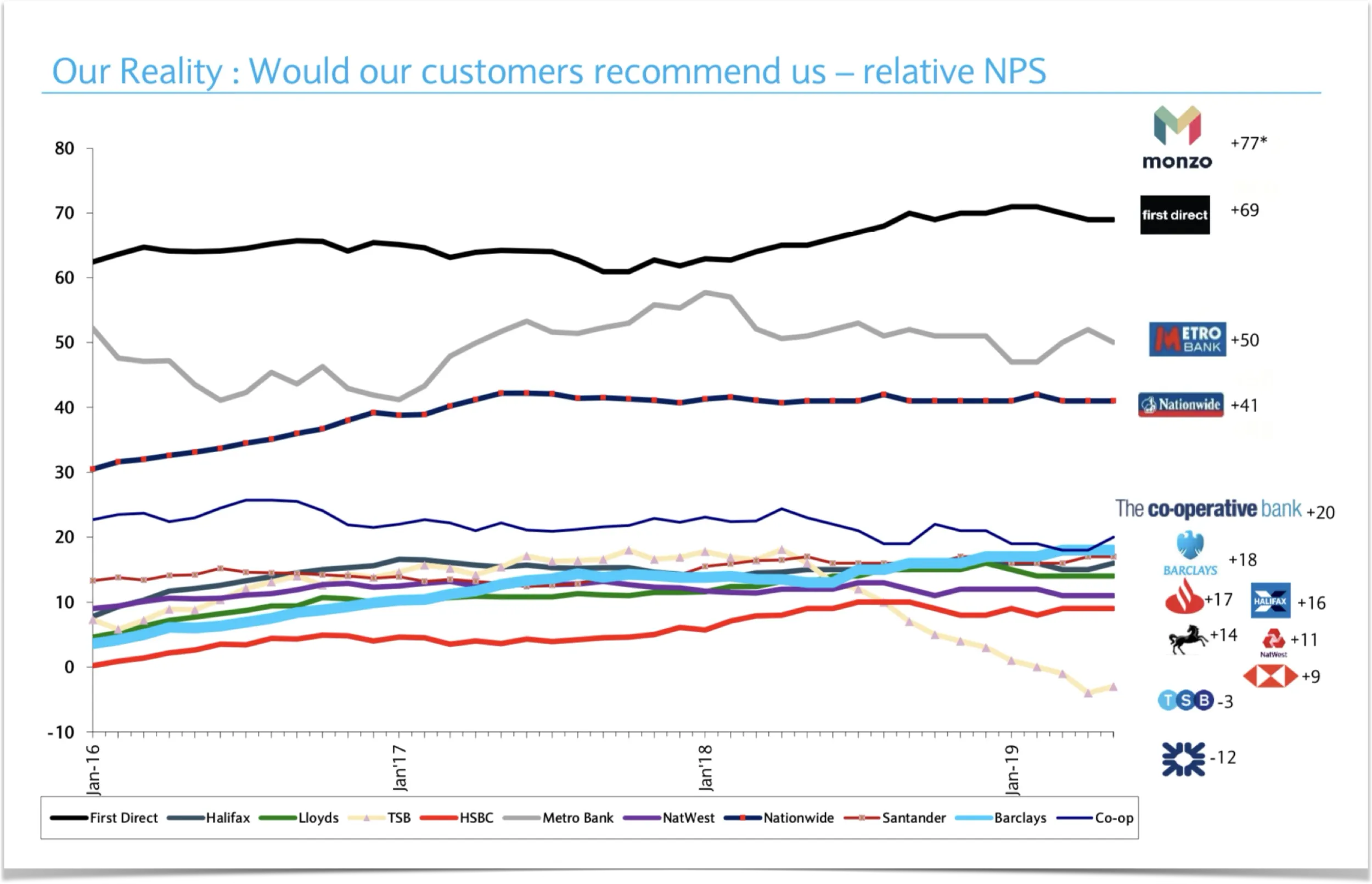

These internal ambiguities were compounded by external pressures. Key performance indicators, notably a relative Net Promoter Score (NPS) of +18 in early 2019, starkly illustrated a customer satisfaction gap when compared to market-leading challenger banks and even some traditional competitors. The operational landscape also presented hurdles, with a high average cost to serve each customer (£92 per annum) and a significant portion of human interactions (85%) dedicated to servicing simple transactions. This pointed to a pressing need for operational efficiencies that would free up colleagues to engage in more complex, value-adding support. The fundamental challenge, therefore, was to cut through this complexity, transform Barclays’ operational model, and address the underlying customer perception issues to build genuine, lasting confidence.

3. Our Approach: Building Confidence through a “Truly Connected Finance” Toolkit

To navigate these challenges, our approach was encapsulated by the principle “Simplify to Clarify.” The mission was to make “Truly Connected Finance” a tangible reality by developing a comprehensive “TCF Toolkit.” This toolkit was conceived with two primary objectives: firstly, to Operationalise TCF through four robust decision-making tools that would foster internal alignment and empower tangible progress; and secondly, to Socialise TCF using two dedicated storytelling tools designed to make the vision palpable and instil a sense of hope and engagement across the organisation and, ultimately, with customers.

At the heart of this strategic endeavour was a profound commitment to “building confidence.” In an era where customers increasingly sought stability and assurance, Barclays aimed to be an institution that helped individuals and businesses “go forward with confidence,” thereby “creating opportunities to rise.” This vision was not merely aspirational; it was grounded in a practical strategy to leverage Barclays’ considerable assets in “data, digital, people & partnerships.” The goal was to “Truly Connect” these strengths more effectively and, most importantly, to “Truly Connect more personally to people.” The desired behavioural shift was to cultivate an environment of “spreading ripples of hope, one conversation at a time,” moving beyond transactional interactions towards a more empathetic and supportive relationship model. This approach necessitated a fundamental shift in decision-making, prioritising not just commercial viability and capability, but also the resonance of initiatives with the TCF North Star—its impact on brand perception and customer confidence—and, critically, whether the customer would “love it,” as measured by indicators like NPS.

4. The Process: Immersing, Envisioning, and Socialising TCF

The journey to define and articulate the “Truly Connected Finance” strategy was a dynamic, multi-phase process, meticulously designed to ensure that the resulting framework was both ambitious and actionable.

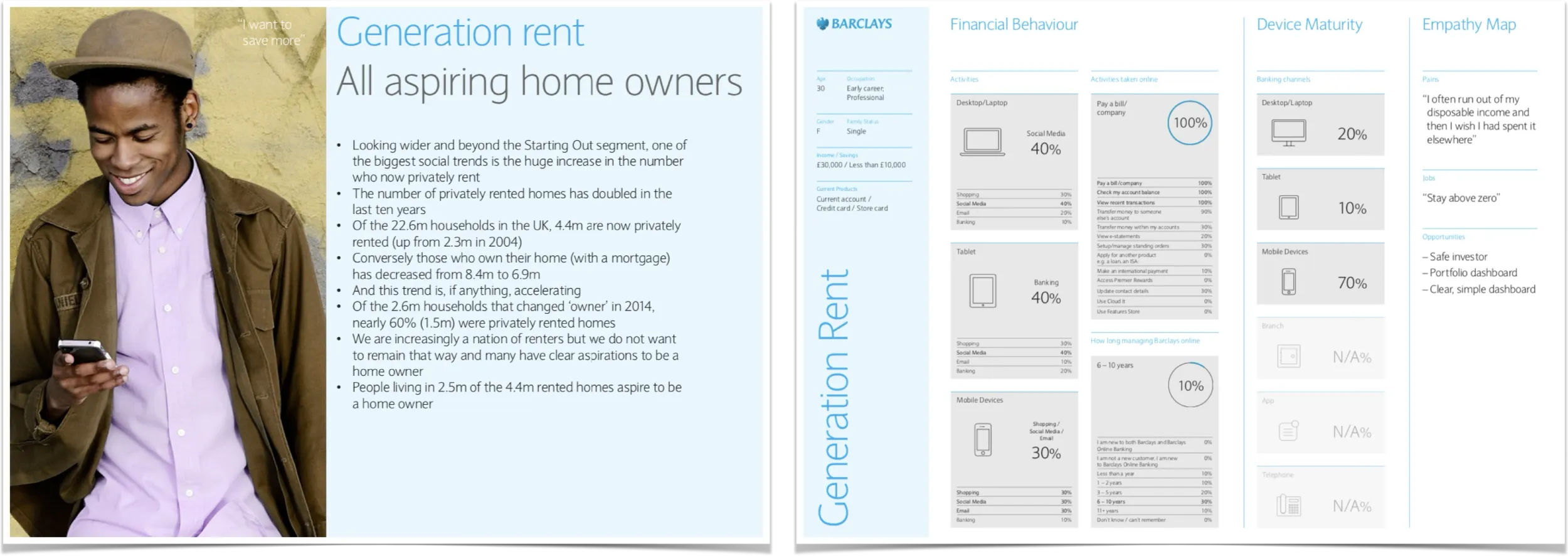

The initial “Immerse” phase, spanning two weeks, was dedicated to deep learning and insight generation. Our team delved into existing Barclays documentation, reviewed current project plans, and undertook extensive secondary research. This foundational work explored several critical “areas of interest”: understanding Customers across different life stages (from “Early Life” to “Later Life”) and through defined personas (“Project Chrysalis”); analysing the Competition, including traditional banks, nimble fintechs, and influential non-financial brands shaping customer expectations; scrutinising key KPIs, with a strong focus on Net Promoter Score; understanding core Business Drivers, such as the imperative to reduce the cost-to-serve; and considering the perspectives and operational realities of Barclays Colleagues.

Following immersion, the “Envision” phase (also two weeks) focused on synthesis and creation. Drawing upon the insights gathered, we developed strategic hypotheses to guide the formulation of the TCF vision and its associated Customer-Value-Propositions. This involved crafting draft CVPs that would articulate the tangible benefits for customers and shaping a singular, compelling vision statement for “Truly Connected Finance.”

Throughout these initial phases, Stakeholder Engagement was paramount. The process commenced with a stakeholder engagement plan, identifying key individuals across the business for interviews and workshops. These interactions were crucial for gathering diverse perspectives, understanding internal requirements, and ensuring the TCF strategy would resonate within the organisation. The “Observation Headlines” generated early in the project served as a vital tool, reflecting the collective understanding of internal strengths and challenges. As the TCF vision and toolkit began to take shape, subsequent workshops were held to present the evolving framework, demonstrate its mechanics, and solicit iterative feedback.

The final two-week “Socialise” phase was dedicated to refining and disseminating the TCF strategy. This involved testing the core vision and CVPs with stakeholders to ensure clarity and buy-in. We developed storyboarded scenarios to bring “signature moments” of the TCF experience to life, making them more tangible and relatable. The toolkit developed included the “TCF North Star,” the refined “TCF Prioritisation Criteria,” the overarching “TCF Framework,” and a detailed “TCF Roadmap.” These elements were designed to empower more discerning, customer-centric decisions at all levels, from daily operations to strategic investment choices, ensuring that every initiative would demonstrably contribute to the TCF vision.

5. Outcomes & Impact: A Roadmap to Renewed Customer Confidence

The “Truly Connected Finance” initiative culminated in a comprehensive strategic toolkit and a clear roadmap designed to guide Barclays towards a future of enhanced customer relationships and renewed market distinction. The primary outcome was the TCF Toolkit itself, a suite of resources intended to embed a new way of thinking and operating within the bank. This included the aspirational TCF North Star, a new, more holistic set of TCF Prioritisation Criteria (balancing Brand, Capability, Commercial, and Customer impact), the guiding TCF Framework, and a multi-year TCF Roadmap detailing specific initiatives.

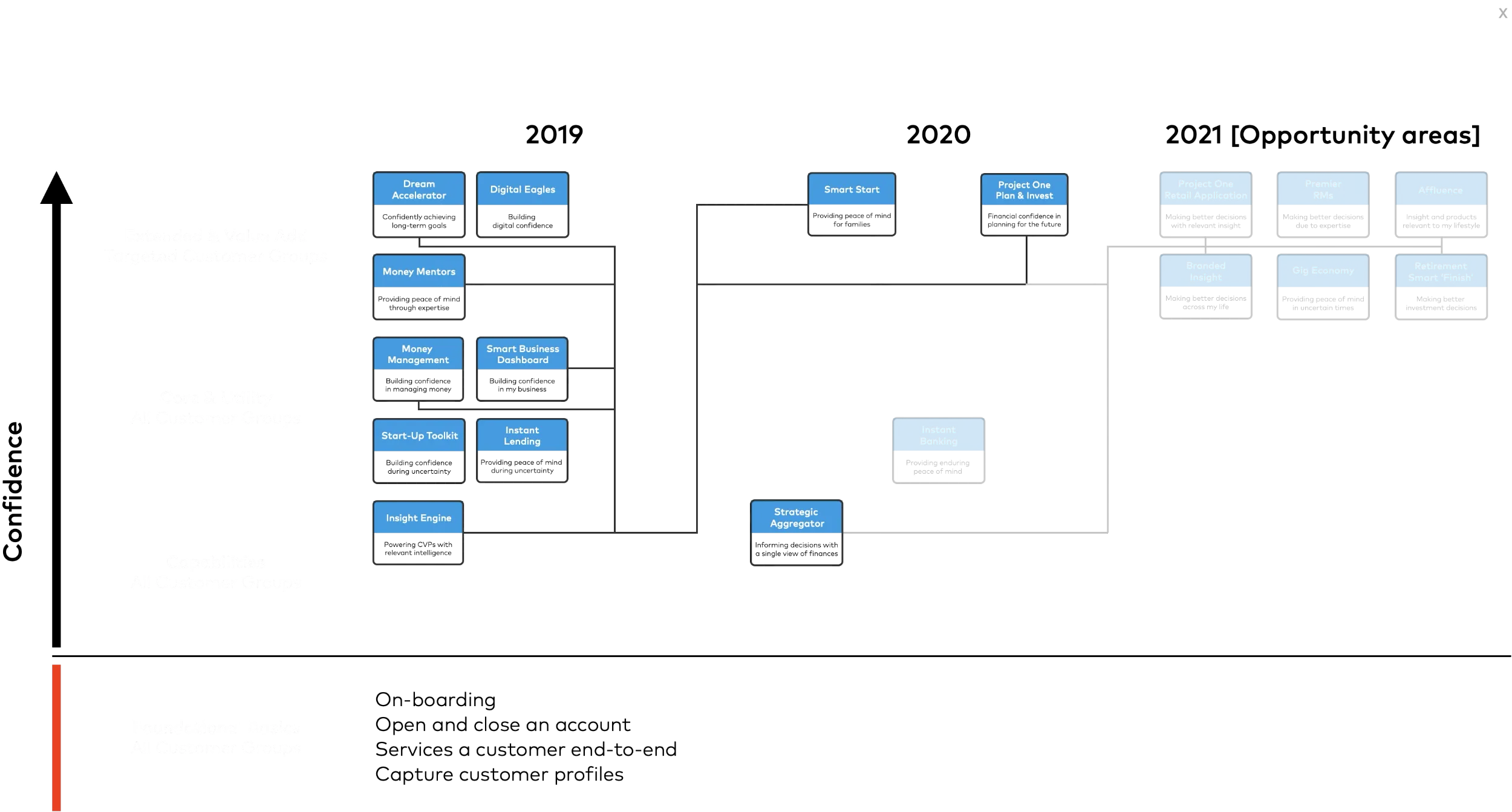

This roadmap articulated a clear, phased approach to “building confidence.” It began with the crucial step of “fixing the pain points that erode confidence,” thereby earning Barclays the “permission to build confidence” further. This foundational layer focused on getting the basics right – seamless on-boarding, efficient account management, and comprehensive customer profile capture. Upon this foundation, the strategy proposed layering on advanced Capabilities, such as a sophisticated “Insight Engine” to power CVPs with relevant intelligence and enable more personalised interactions. Building further, Core & Utility offerings, like “Money Management” tools, were designed to instil confidence in day-to-day financial management. Finally, Extended & Value-Add services, exemplified by the “Dream Accelerator,” aimed to support customers in achieving their long-term goals. Initiatives such as the “Insight Engine” and “Money Management” were slated for 2019, with “Dream Accelerator,” “Smart Start,” and “Project One Plan & Invest” among those planned for 2020, and further opportunity areas like “Financial Wellness” and “Retirement Toolkit” identified for 2021 and beyond.

The early “Observation Headlines” provided critical learnings, highlighting not only areas of internal misalignment (such as conflicting views on immediate priorities and unaligned investment) but also a strong collective desire for positive change and a clear understanding of where Barclays could differentiate itself. The challenging NPS position and high operational costs underscored the necessity for this transformative approach.

The envisioned impact of the TCF strategy was profound. By systematically implementing the toolkit and roadmap, Barclays aimed to significantly improve its Net Promoter Score, manage operational costs more effectively by empowering both customers and colleagues, and clearly differentiate itself in a competitive marketplace. More fundamentally, the “Truly Connected Finance” initiative was designed to foster a culture where every interaction and every product would contribute to “spreading ripples of hope,” ultimately instilling “confidence in the future, one conversation at a time” for all Barclays customers.

Concluding Vision: Forging Barclays’ Future as a Truly Connected Financial Partner

Ultimately, the “Truly Connected Finance” initiative represented far more than a strategic exercise for Barclays; it was the blueprint for a transformative journey towards becoming a profoundly more customer-centric and responsive organisation. By anchoring its ambitious vision in a deep understanding of customer anxieties, internal operational realities, and the dynamic competitive landscape, the TCF Toolkit and its accompanying roadmap provided Barclays with a clear and actionable pathway. This strategic framework was designed not merely to introduce new products or services, but to fundamentally reshape the bank’s engagement model, fostering a new era of proactive support and personalised value. The envisioned “win-win” was clear: a future where Barclays could achieve enhanced Net Promoter Scores, greater operational efficiency, and distinct market differentiation, while simultaneously empowering its colleagues. For customers, the promise was even more profound – a shift from transactional interactions to a supportive partnership, building enduring confidence and “spreading ripples of hope” for a more secure and optimistic financial future, one truly connected conversation at a time. This was Barclays’ commitment to becoming an indispensable financial partner in the lives of those it served.