Service Design Case Study: Barclays Mortgages Application & Appointment Experience

A comprehensive Service Design case study detailing the research, strategy, and proposed solutions for enhancing the Barclays mortgage application and appointment journey for customers and colleagues.

Published: 15 January 2024

The Starting Point: Reimagining the Barclays Mortgage Journey

The Barclays mortgage experience, a critical touchpoint for millions, presented a significant opportunity for transformation. Our challenge, and the core “ask” for this service design initiative, was to create a natural, customer-focused interview and product recommendation experience where all known information is pre-populated, ensuring the decision to lend is understood with confidence by both the customer and the bank.

We embarked on this journey with the ambitious goal of not only enhancing customer delight and operational efficiency but also positioning Barclays as an exemplar of best practice in the eyes of the Financial Conduct Authority (FCA). Our collective team, comprising service designers, researchers, and collaborators from Barclays’ technology, product, and frontline departments, set out to address this by redesigning the end-to-end mortgage service.

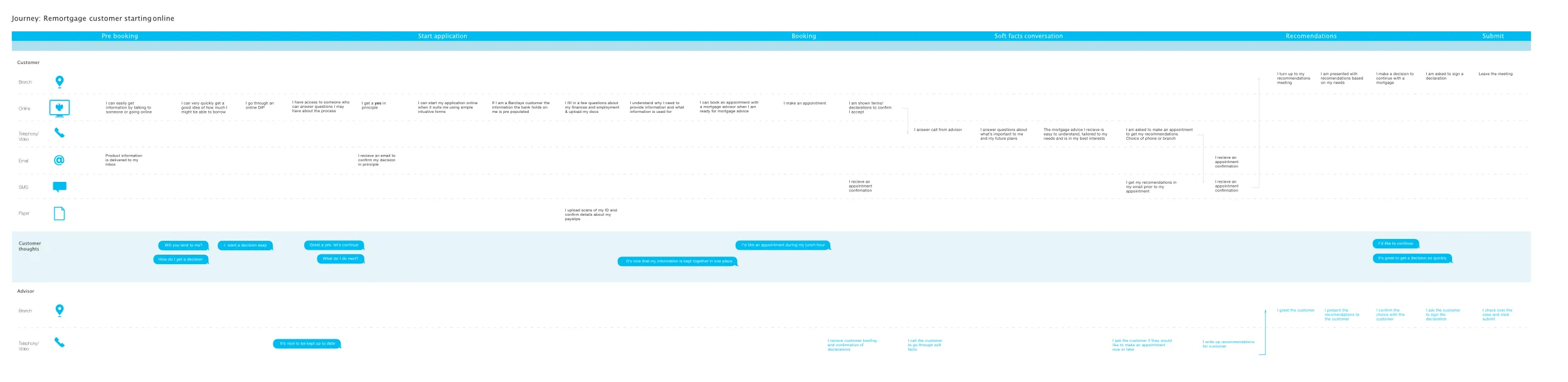

The scope of our work was comprehensive. We delved into customer interactions across every channel – online, phone, and in-branch – examining advisor tools, existing processes, backend systems (including legacy platforms), and overarching communication strategies. Our focus extended to critical moments like the initial customer interview, product recommendation, the intricacies of application processing, and the ongoing dialogue with customers throughout their journey. A key consideration from the outset was to cater to diverse customer segments, including a significant “digitally passive” group, ensuring the new service would be inclusive and accessible. We structured our approach in distinct phases: beginning with a deep “Understand” phase to uncover insights, moving through an intensive “Explore” phase involving three targeted design sprints (focusing on Quality Conversation, Firm Lending Decision & Communication Design, and Advisor UX respectively), and finally, a “Deliver” phase to consolidate our findings and propose actionable recommendations.

Understanding the Terrain: Customer Pains and Business Hurdles

Our initial “Understand” phase quickly revealed a multifaceted challenge within the existing mortgage application and appointment service. We found that both customers and colleagues were navigating a fragmented and often cumbersome experience, which led to significant inefficiencies, customer dissatisfaction, and potential regulatory concerns for Barclays.

One of the most pressing issues we uncovered was the considerable difficulty and confusion customers faced. Many struggled to differentiate between various mortgage products, feeling overwhelmed by the sheer number of choices. The application process itself was often perceived as complex and opaque, breeding frustration and increasing the likelihood that customers would either abandon their applications or turn to external brokers and comparison sites for clarity. This anxiety was compounded by a lack of transparency regarding data requirements and how their information would be used, alongside insufficient proactive communication about their application’s progress. We identified a particularly vulnerable group in the “Digitally Passive” segment – 1.4 million customers who were hesitant to use online channels due to deep-seated concerns about making mistakes, ensuring accountability, and maintaining their security.

Internally, we observed significant operational inefficiencies that directly impacted colleague frustration and productivity. Advisors reported spending an inordinate amount of appointment time on manual data entry or re-entry, even for information customers had previously supplied. This wasn’t just an inefficient use of skilled advisors’ time; it was a clear source of frustration for both staff and the customers waiting. The existing systems, including a legacy platform known as “Max,” didn’t facilitate a smooth flow of information. For instance, an Agreement in Principle (AIP) might be generated with a reference number, but the crucial associated details often failed to carry over into other systems, leading to disjointed internal workflows. Furthermore, delivering a consistently high-quality service across different channels – telephony, branch, and online – proved to be a major hurdle, with existing processes often creating siloed experiences rather than seamless, integrated ones.

Beyond these systemic issues, we also identified cultural and capability hurdles within the organization. There was a strong aspiration to shift from a transactional culture of ‘order taking’ and ‘application processing’ towards one centered on providing ‘holistic advice.’ This, however, presented a cultural challenge. We also noted concerns about the varying capabilities among advisors and their comfort levels with the new skillsets and approaches that a redesigned service would demand. Consequently, training frontline staff and market leaders effectively, alongside the substantial task of updating extensive supporting documentation like screen layouts, call scripts, and quality assurance standards, were recognized as critical undertakings. Compounding this was the realization that the prevailing “one-size-fits-all” process struggled to meet the diverse needs of various customer segments, including contractors, first-time buyers (FTBers), and those looking to remortgage (often referred to as ‘remos’ in our project documentation).

Collectively, these deeply intertwined challenges were impacting Barclays across several key metrics: customer satisfaction, as measured by tools like the Net Promoter Score (NPS); operational capacity, including the target of 2.5 mortgage applications per advisor per week; overall colleague engagement; and the bank’s overarching ambition to meet and exceed the high standards of conduct set by the Financial Conduct Authority (FCA).

Our Design Journey: From Insight to Action

With a clear understanding of the customer pains and business hurdles, our journey shifted towards co-creating solutions. We adopted a classic service design thinking process, moving through distinct phases, underpinned by behavioural science principles and collaborative ideation, to ensure our solutions were both user-centric and strategically sound.

Our “Explore” phase was where potential solutions began to take shape. This involved a series of agile sprints, each with a specific lens, allowing us to tackle different facets of the mortgage experience. Sprint 1 was dedicated to enhancing the “Quality Conversation” between advisors and customers. Sprint 2 focused on the critical “Firm Lending Decision & Communication Design,” aiming for clarity and confidence. Finally, Sprint 3 honed in on the “Advisor User Experience (UX),” ensuring that colleagues would be well-equipped to deliver the redesigned service. Throughout these sprints, we iteratively developed and refined prototypes. For example, we mocked up mobile application screens to visualize a smoother payment process, emphasizing aspects like intuitive payee selection, confirmation screens leveraging pre-populated data, and clear payment receipts with user-friendly notification options. We also pushed creative boundaries by exploring “What if…” scenarios, such as envisioning mortgage appointments with the convenience of Ocado deliveries or transforming the entire application into a natural conversation, potentially leveraging channels like WhatsApp.

To guide our thinking, particularly around encouraging the adoption of digital channels by the “Digitally Passive” segment, we applied the Fogg Behavioural Model (Behaviour = Ability x Motivation x Trigger). This framework helped us identify how to enhance customers’ ability (e.g., through more intuitive interfaces), boost their motivation (by highlighting clear benefits), and design effective triggers to prompt desired actions.

Collaboration was central to our process. We utilized structured group activities and workshops, bringing together diverse stakeholders from across Barclays. These sessions were instrumental in analyzing research findings, collectively mapping customer journey friction points, classifying ‘migratable’ (i.e., suitable for digital channels) versus ‘non-migratable’ payment behaviours, and identifying specific opportunities to nudge customers towards digital engagement. This ensured a shared understanding of the problem space and fostered co-ownership of the emerging solutions.

The insights and ideas generated through research and these collaborative efforts were made tangible through prototyping and iterative user testing. The learnings from user testing in Sprints 2 and 3 were particularly crucial, directly informing the refinement of our designs for lending decisions, communication, and the overall advisor UX. This iterative loop of building, testing, and learning ensured our solutions were continuously validated against real user needs.

Finally, our “Deliver” phase focused on consolidating these validated concepts. We finalized the recommended service model and a comprehensive service blueprint, distilling all our insights into actionable 30, 60, and 90-day recommendations. This culminated in the formulation of a multi-layered strategic framework designed to achieve the project’s ambitious goals. This framework comprised:

- Layer 1: A Segmented Approach to Customers: Tailoring support and experiences based on customer knowledge (novice vs. expert) and their value to the business, with a strategic focus on the most profitable segments.

- Layer 2: Efficiency Gains via Pre-population and Self-Serve: Streamlining the application process by removing costs, enhancing speed, and leveraging pre-filled data to provide more competitive rates and a more personalized service.

- Layer 3: Data-Driven Intervention: Implementing continuous monitoring of customer behaviour to enable targeted, personalized communications and proactive support at the most valuable intervention points.

This journey, from deep understanding through collaborative exploration to strategic definition, was guided by the overarching “Ask”: to create a natural, customer-focused mortgage experience where information was pre-populated and lending decisions were understood with confidence by everyone involved.

Key Discoveries and Envisioned Solutions

Our intensive design journey, from deep-seated research to collaborative ideation and strategic formulation, unearthed a wealth of insights. These discoveries not only validated many of our initial assumptions but also illuminated the path towards a significantly enhanced mortgage experience. We systematically built our foundation of understanding through several key data collection and analysis streams:

-

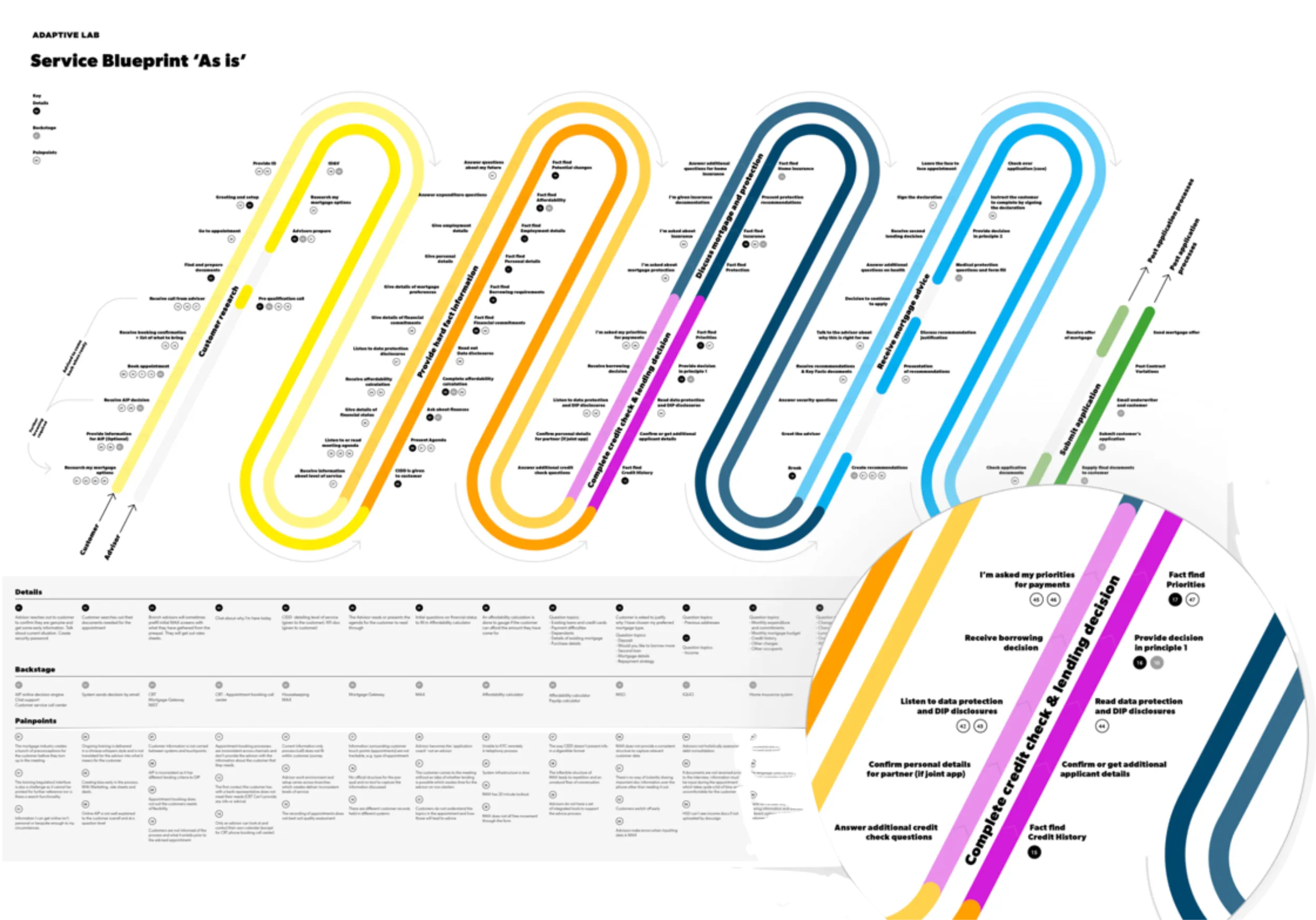

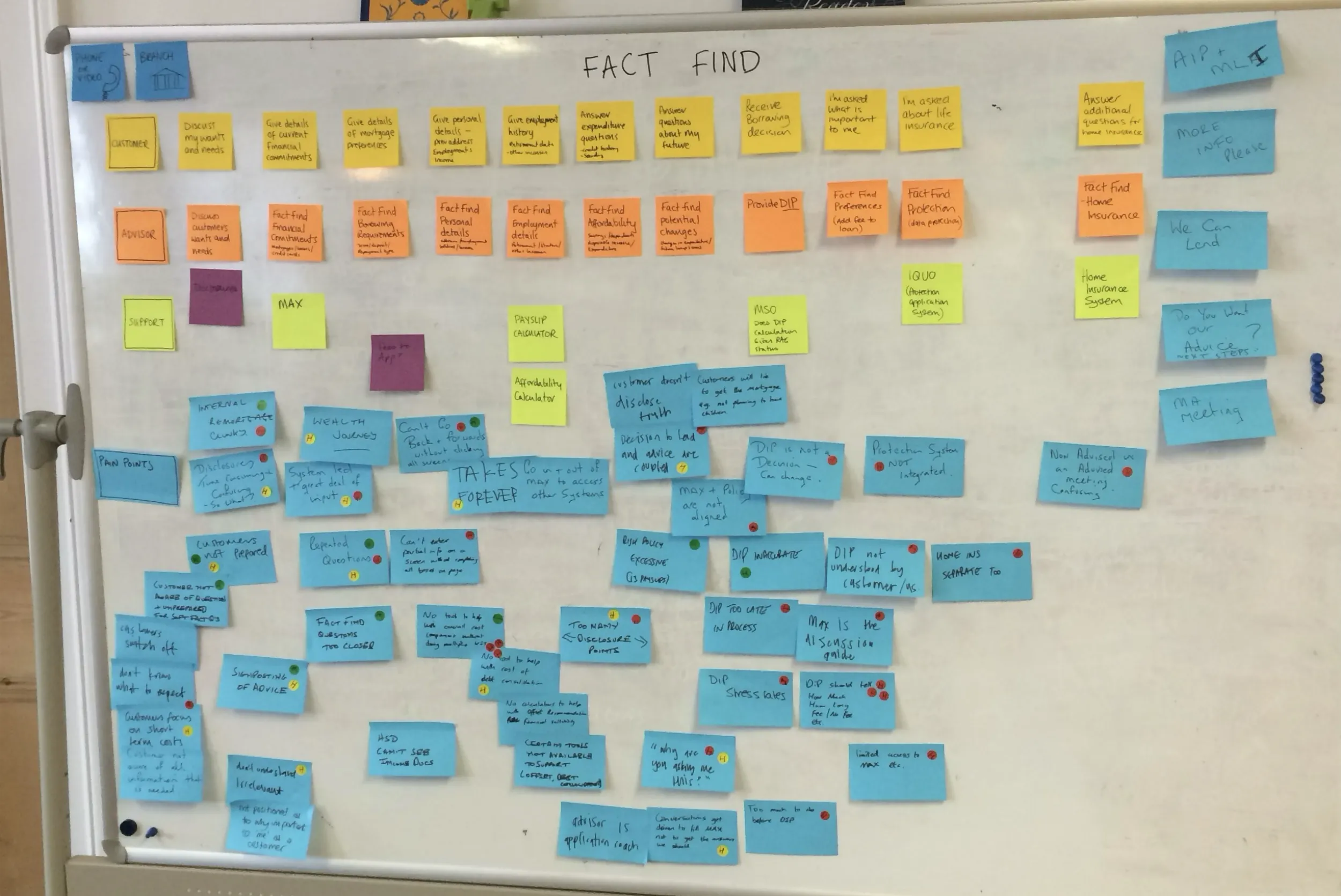

Immersive Research & Journey Mapping: We began by diving deep into the existing mortgage journey. This involved direct observation of prevailing processes and detailed customer journey mapping to visualize the current state experience across multiple channels. Crucially, we conducted extensive interviews with stakeholders and frontline staff, which were invaluable in capturing internal perspectives, operational realities, and existing pain points from those closest to the service.

-

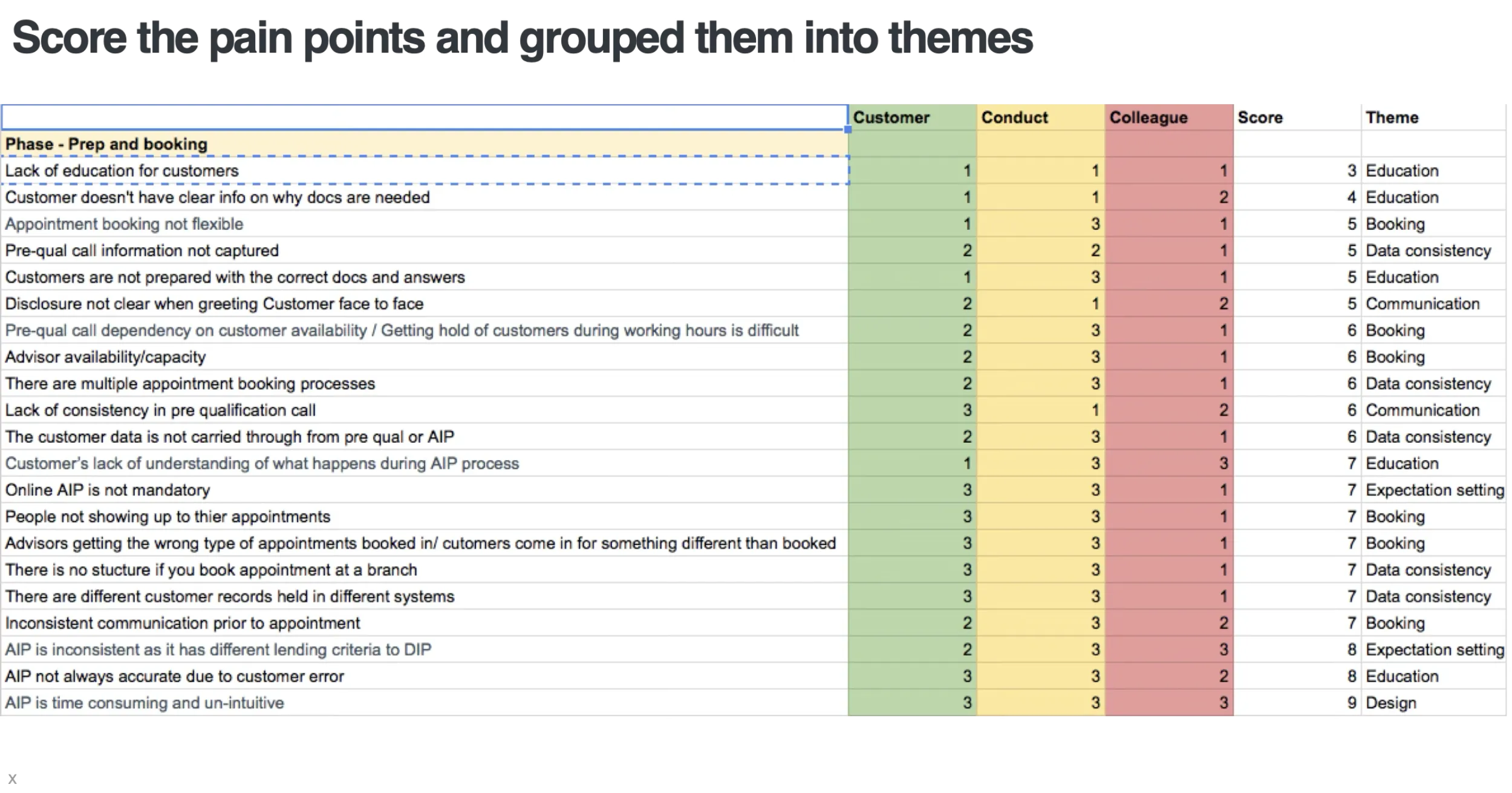

Systematic Pain Point Prioritization: To bring structure to the multitude of issues identified, we undertook a systematic pain point mapping and scoring exercise. Specific issues, such as a “lack of education for customers” or “pre-qual call information not being captured,” were grouped into broader themes like Education, Booking, and Data Consistency. Each pain point was then scored based on its perceived impact on the Customer experience, Conduct (regulatory compliance), and Colleagues. This data-driven approach provided us with a clear, evidence-based framework for prioritizing which areas required the most urgent attention and would yield the greatest positive impact.

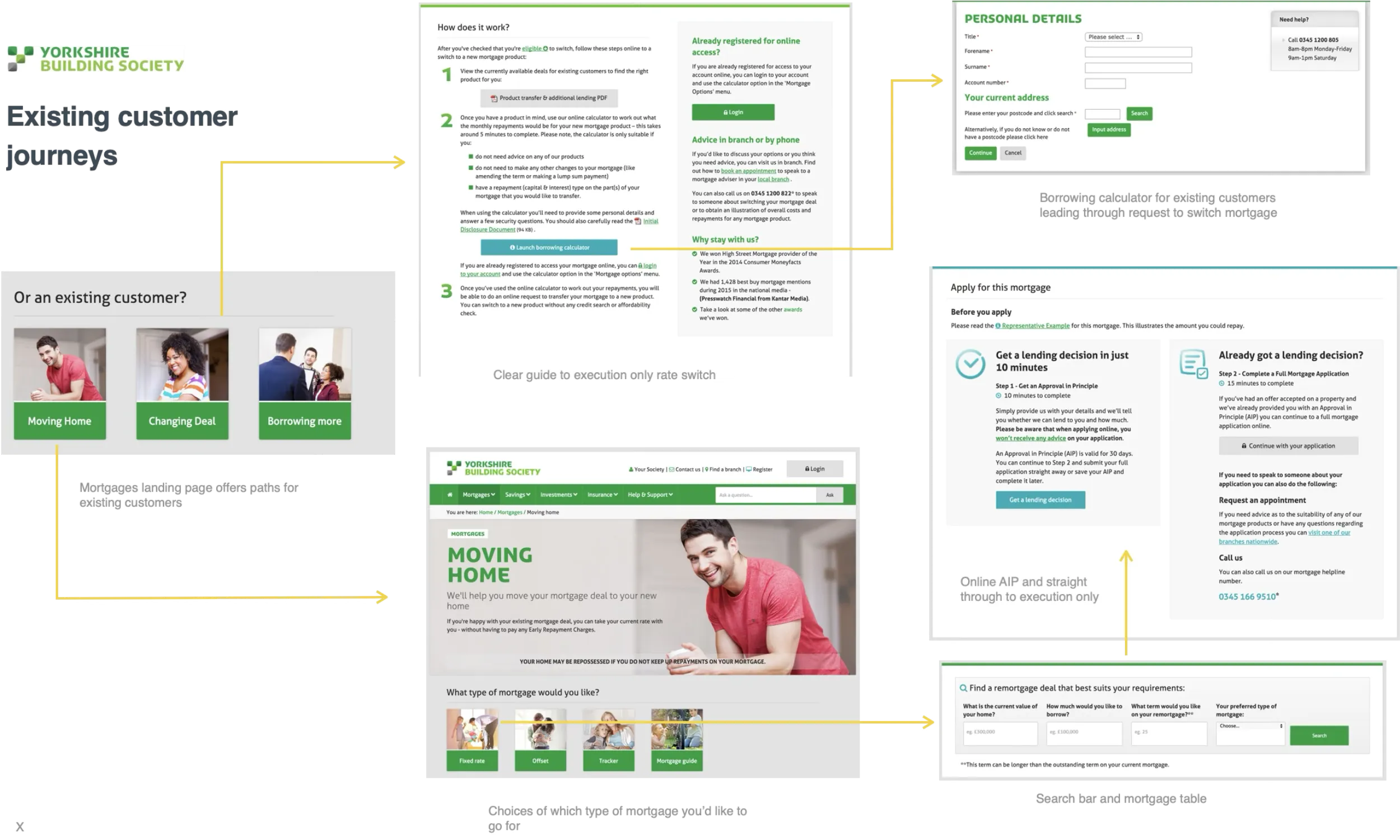

- Understanding the Competitive Landscape: A comprehensive competitor review allowed us to benchmark Barclays’ online mortgage offerings against key industry players, including YBS, Natwest/RBS, and Lloyds. This analysis helped us identify areas of feature parity, as well as potential opportunities for differentiation and innovation.

-

Direct Voice of the Customer: To ensure our insights were genuinely customer-centered, we engaged in direct customer research, which included methods like mystery shopping. This allowed us to experience the service from a customer’s viewpoint and capture firsthand learnings about their experiences, frustrations, and desires.

-

Formulating and Validating Hypotheses: Throughout this discovery phase, we proactively captured our working assumptions about user behaviour (e.g., “Users are not aware of the next steps throughout the process”) and translated these into specific, actionable hypotheses. For example, we hypothesized that customers found the differences between Barclays’ mortgage products hard to understand (Customer Hypothesis #1) and that they struggled with the complexity of the application steps (Customer Hypothesis #2). These hypotheses were then carried forward to guide our solution design and subsequent validation efforts. Our findings strongly indicated significant opportunities to improve customer understanding of products and processes. The desire for transparency in data usage, easier document uploading, readily available and context-aware support, and the re-use of existing customer data (as highlighted in our ideal “to-be” online remortgage journey) was a clear and consistent theme.

-

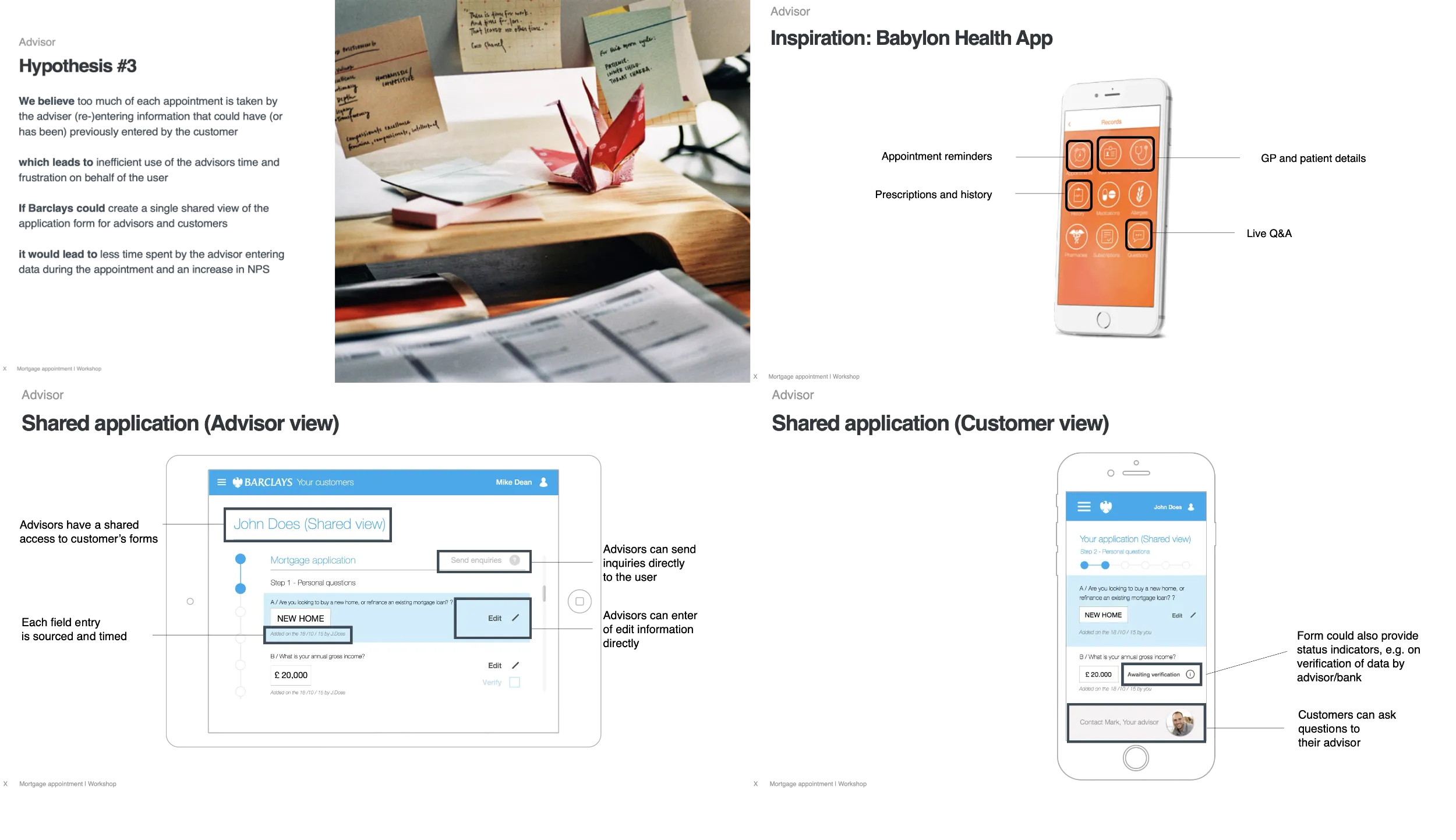

Identifying Advisor Inefficiencies and System Gaps: Our research also substantiated the hypothesis that advisors were spending excessive time on manual data re-entry due to disconnected systems (Advisor Hypothesis #3). The detailed service blueprint we developed highlighted specific system limitations, such as AIP reference numbers failing to carry comprehensive data across different platforms, leading to operational friction.

-

Highlighting Communication Deficiencies: A strong finding (validating Advisor Hypothesis #4) was the critical need for more proactive and transparent communication, particularly regarding the status of an application after submission, as current practices were often a source of customer anxiety.

-

Recognizing the Needs of the “Digitally Passive”: A significant discovery was the identification of a substantial “Digitally Passive” customer segment, numbering around 1.4 million. We learned that their concerns about making mistakes, ensuring accountability, and maintaining security were key barriers to their adoption of digital channels, requiring specific design considerations to address.

These deep insights directly informed the suite of solutions we envisioned to meet the project’s core “Ask.” Our recommendations were designed to create a more intuitive, transparent, and supportive mortgage experience:

- Crafting an Enhanced Digital Experience: A cornerstone of our vision was a significantly enhanced digital journey. We proposed implementing intuitive online forms and a straightforward, easy-to-use document uploading system. Crucially, we recommended ensuring that if customers encountered difficulties online, they could instantly connect with a support team member who would already know who they were and have context for their query. This approach directly addressed the needs highlighted in our ideal “to-be” online remortgage journey.

-

Driving Efficiency Through Data Pre-population & System Integration: To tackle advisor inefficiencies and customer frustration, a core recommendation was to ensure customer data is pre-populated wherever possible. This meant better integration between systems, including the platform handling AIPs and the main “Max” system, to create a single, shared view of the application for both customers and advisors. This was a direct response to the challenges validated by Advisor Hypothesis #3.

-

Fostering Trust with Improved Communication & Transparency: We advocated for implementing systems that would provide customers with proactive updates on their application status. Alongside this, we recommended providing clear, inline explanations of information requirements and lending details, presented separately from the initial fact-find process. These measures aimed to alleviate customer anxiety (addressing Advisor Hypothesis #4) and meet their expressed needs for clarity.

-

Empowering Customers with Better Product Understanding: To help customers navigate the complexities of mortgage products, we proposed developing tools or methods embedded within the application process itself. The goal was to make customers more informed, thereby making subsequent advisor sessions more productive and reducing the reliance on external comparison sites, as outlined in Customer Hypothesis #1.

-

Simplifying the Journey with a Guided Application Process: Addressing the difficulties customers faced in managing application steps (Customer Hypothesis #2), we envisioned a tool that would walk them through the process as a series of clear, manageable tasks, thereby improving completion rates and reducing the need for extensive advisor support.

-

Exploring “What If…” Innovations for Future Evolution: Looking beyond immediate enhancements, we also tabled more radical, longer-term innovations. These included concepts like “mortgage appointments like Ocado deliveries” – offering the convenience of in-home advisor consultations after an initial online information gathering “order” – and the idea of an “application as a conversation,” potentially leveraging channels like WhatsApp to minimize traditional forms and make the process feel more natural and accessible.

These envisioned solutions, born from our detailed research and collaborative design process, formed the practical blueprint for transforming the Barclays mortgage service into a truly customer-centric and efficient operation.

Strategic Impact and Future Outlook

The comprehensive service design initiative for the Barclays Mortgages experience was not just an academic exercise; it was architected to deliver tangible, strategic impact across the business and for its customers. We projected that the implementation of our recommendations would yield significant, quantifiable benefits, creating a positive ripple effect.

Projected Business and Customer Outcomes:

Our multi-layered strategic approach was designed to directly address the initial project goals, with clear anticipated outcomes:

-

For the Customer Experience: We envisioned a future where customers felt truly delighted and empowered. This meant clearer understanding of products and processes (expected to improve Net Promoter Score (NPS) and customer questionnaire feedback), more productive advisor sessions due to better-informed customers, and a significant reduction in anxiety thanks to transparent processes and proactive communication.

-

For Company Performance & Efficiency: The redesigned service was projected to directly boost operational capacity. By streamlining processes and reducing manual data entry for advisors, we aimed to help them meet and exceed the target of 2.5 mortgage applications per week. The financial benefits were also substantial, with our three-layered strategy forecasting:

- Approximately £16 million per year from increased conversion rates within targeted customer segments.

- Around £20 million per year driven by reduced meeting times, an increased number of appointments, and improved overall conversion.

- An estimated £5 million per year from data-driven interventions leading to higher conversion and faster application processing times. Furthermore, we anticipated higher rates of successful application completion with less intensive advisor input.

-

For Colleague Satisfaction & Enablement: We aimed to equip advisors with superior tools and more efficient processes. This would lead to more rewarding, quality conversations and, consequently, higher colleague satisfaction (as measured by tools like EOS – Employee Opinion Surveys), alongside reduced frustration from cumbersome data handling.

-

For Conduct & Regulatory Standing: A core ambition was for the redesigned service to stand as an exemplar of best practice for the Financial Conduct Authority (FCA), robustly meeting newly defined quality standards and reinforcing Barclays’ commitment to responsible lending.

Key Learnings from Our Journey:

This intensive service design project yielded several crucial learnings that we believe hold value beyond this specific initiative:

- Addressing the “Digitally Passive”: We learned the critical importance of deeply understanding and specifically addressing the needs and anxieties of “Digitally Passive” customers. Simply providing digital tools is insufficient; the design must actively build trust and demonstrate clear value to encourage adoption.

- The Power of Phased Design: The efficacy of a structured, phased service design approach (Understand, Explore, Deliver) was reaffirmed. It allowed us to systematically deconstruct a complex challenge, build understanding incrementally, and develop robust, well-validated solutions.

- Behavioural Science in Action: Applying behavioural models like Fogg’s proved highly effective in identifying leverage points for encouraging positive behaviour change, offering a structured way to think about enhancing ability, motivation, and triggers.

- The Imperative of Integration: Perhaps one of the most significant learnings was the absolute necessity of deep system integration and intelligent data pre-population. These are not just “nice-to-haves” but fundamental enablers of truly efficient, customer-centric service experiences.

A Concluding Vision: